How to Estimate Your Future Net Worth and Build Wealth for Tomorrow

The “Future net worth” is an important topic for anyone looking to improve their financial future. It helps you estimate how much money you’ll have in the coming years by understanding your income, savings, and investments. Knowing your future net worth is key to planning for retirement or big life goals.

Understanding Future Net Worth: Why It Matters

The future net worth helps you see where you could be financially in the years to come. It gives you a clearer picture of how much wealth you will likely have after considering your current assets, savings, and income. By understanding your future net worth, you can make better financial choices.

Predicting future net worth is not just about guessing numbers. It’s about planning for what’s ahead and setting goals. For example, if you know that you need to save for your children’s education or your retirement, understanding future net worth can help you know how much to save.

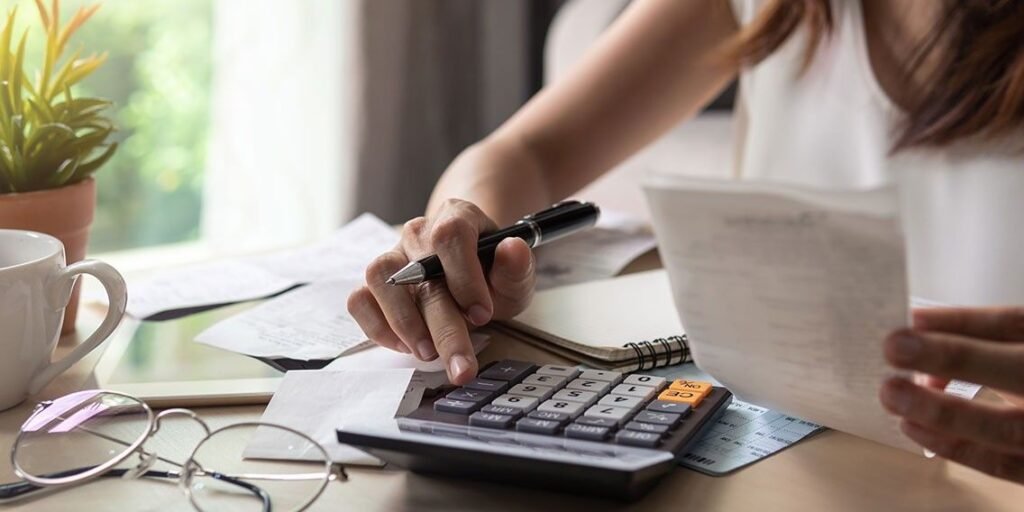

How to Calculate Your Future Net Worth

Calculating your future net worth can be done by looking at what you own now and what you expect to own in the future. Start by listing your assets, like property or savings, and subtracting any debts. Then, consider how much money you plan to save each month and the growth of your investments.

Once you have these numbers, use an online net worth calculator to predict how your wealth will grow over time. This helps you see if you’re on track to meet your financial goals or if you need to make changes.

Key Factors That Affect Your Future Net Worth

Several factors can affect your future net worth. These include your income level, savings rate, and the return on your investments. The more you save and invest wisely, the higher your future net worth will be.

Additionally, how much you spend each month and any debts you carry can also impact your future net worth. Keeping expenses low and paying off debts can help improve your financial outlook.

Why Starting Early Can Boost Your Future Net Worth

Starting to save and invest early is one of the best ways to increase your future net worth. When you start saving early, your money has more time to grow. This is because of the power of compound interest, where you earn interest on both the money you save and the interest it earns.

The earlier you start, the more time your investments have to grow. Even small contributions to savings or investment accounts can add up over time, making a big difference in your future net worth.

The Role of Investments in Growing Your Future Net Worth

Investments play a huge role in building your future net worth. By investing in stocks, bonds, or real estate, you can earn returns that help your money grow faster than just saving in a bank account.

Different types of investments come with different levels of risk and potential reward. It’s important to do research and consider speaking with a financial advisor to find the best investment strategy for your goals.

Saving Strategies to Increase Your Future Net Worth

There are many ways to save money that can help boost your future net worth. Setting up automatic savings from each paycheck is one great way to save without thinking about it. Another strategy is to live below your means, meaning you spend less than you earn and save the difference.

Having a clear savings plan can also help you stay on track. Whether you’re saving for retirement, a big purchase, or emergencies, having a strategy is essential to building wealth.

Conclusion

In conclusion, your future net worth is a helpful tool for planning your financial future. By understanding how to calculate it and what factors influence it, you can make smarter decisions about your money. Starting early, saving regularly, and making wise investments are key to growing your wealth over time.

Remember, your future net worth is not set in stone. With careful planning and consistent effort, you can increase it and achieve your financial goals. The sooner you start, the better prepared you’ll be for the future.

FAQs

Q: What is future net worth?

A: Future net worth is an estimate of how much wealth you will have in the future based on your income, savings, and investments.

Q: Why is it important to calculate future net worth?

A: It helps you plan your financial goals and see if you’re on track to achieve them, like saving for retirement or a big purchase.

Q: How can I increase my future net worth?

A: You can increase your future net worth by saving more, investing wisely, and reducing unnecessary spending.

Q: What factors affect my future net worth?

A: Factors like your income, savings rate, investments, and debts can affect your future net worth.

Q: When should I start planning for my future net worth?

A: It’s best to start planning as soon as possible to give your money more time to grow through savings and investments.